Defining the proper price for a property is something extremely relevant for a selling strategy. In the end, if a property is mispriced, it always ends up in a loss to the client: whether they will earn less than they should in the sale or they will have to spend money to keep it while the place awaits a buyer, spending months available on the market.

To make the sale faster for all the right reasons, meaning appropriate pricing that attracts more potential buyers, the estate agent has to rely on a very well done property valuation.

How to get a property valuation online in 2 simple steps

You know and we know that property prices are affected by many different factors. For example:

- Location;

- Amount of rooms and total square meters;

- State of conservation;

- Whether it’s furbished or not;

- Whether there’s a high or low demand for this kind of property;

- How the competitor properties are positioned on the market.

And this is just to name a few. This means that taking all of this into consideration can be a demanding job for the real estate professional, who would have to manually search for information about all of these topics.

But worry not: technology is here to help you along the way. Creating a property valuation online is something that can be done easily, factoring everything aforementioned and taking only a few minutes. How? With CASAFARI, of course.

Use a property valuation tool to create a property valuation

Starting your studies about the property market to define a pricing strategy? Here’s where a market analysis tool comes in handy.

To find the proper values without wasting many working hours, you are going to need a real estate software that can help you create a property valuation online. It should look at the whole market stock and establish comparisons between the property in your portfolio and its competitors.

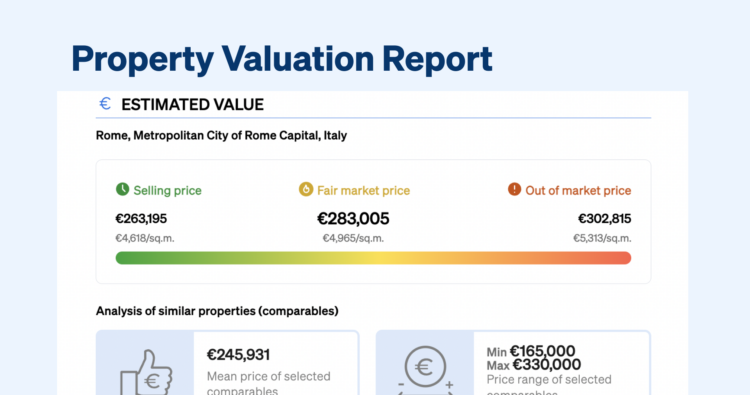

Well, we’ve just described CASAFARI’s Property Valuation. Our tool is a property valuation tool that allows you to find comparable properties by defining a location and a series of characteristics. Meaning, you can count with over 30 filters to find the perfect fit!

After having found the comparables, the tool even provides you with a selling price, a fair market price and an out of market price. This way you will know better than to sell the property for too little or too much.

A true representation of the property market and of your competitors

You may be wondering how can you know that these comparables represent the reality of the market, right?

Well, first of all, you should know that CASAFARI accesses the whole market stock. We’re talking about over 200 million listings and more than 30,000 sources, which means a real estate database 1000x larger than the closest competitor. So, if there’s one thing you can be sure of is that you will be working with a 360º view of the property market.

And if you’re worried about picking the correct properties to be compared with yours, we got you! Besides all the filters, our Property Valuation report can include up to 30 competitor properties to define the pricing strategy: you will not be defining something as important as an asking price based on just a few examples.

Also, you get to choose which properties should be included in the comparison, from the pool of competitors. So, you can make sure only very similar properties are paired.

Understand the property market trends to support the pricing strategy

Ok, now that you know what is going on in the property market right now and which are the properties that will be disputing the attention of potential buyers with yours, we need to look at the bigger picture. It’s time to understand questions like:

- Have properties such as this been increasing or decreasing in value?

- Is there a big demand for properties such as mine or is the supply big enough?

- How long do they usually spend on the market before being sold?

Real estate data like this can – and should – influence your property valuation. After all, If there are just a few properties like yours on the market, the asking price can go up a little, while if the demand is decreasing maybe it would be a good idea to decrease it a notch. However, if properties in this asset class usually take a long time to sell and your client doesn’t want to wait, then lowering the price is a good idea, while raising the price is the correct answer if properties of this kind have been steadily going up in value.

Basically, running a property market analysis allows you to understand the trends and circumstances affecting one specific case.

For a deeper property market analysis that supports your pricing strategy, count on CASAFARI Market Analytics. Our tool shows stock availability, prices per area, distribution per asset class and much more (see all property market trends that can be understood with the help of our real estate software)!

There you go, now you have an accurate property valuation to present to your client and show the reasoning behind the definition of the asking price. And all was done easily and quickly with the help of CASAFARI!

Photo by Patrick Perkins on Unsplash