The new Housing Act 2023 came into force on 26th May, establishing new rules for increasing rents, what can be charged to tenants, tax incentives for owners who put their property on the market at affordable prices and much more. Read on to understand the main changes and how they affect your clients.

What is the new Housing Act?

In an attempt to control rental prices across the country and reduce the number of evictions, Spain has passed its new Housing Act. It redefines aspects of the relationship between landlords and tenants, setting limits on rent increases and tax benefits for owners who add more properties to the rental market.

This is a reaction to the escalating prices in Spain, which have risen significantly, mainly due to a lack of stock. As CASAFARI pointed out in our market report in April 2023, Madrid reached an average of €17 per square metre, surpassed by Barcelona with an impressive price of €22 / sq.m.

Strained zones and definitions of large and small landlords

In order to understand the changes brought about by the 2023 Housing Act, it’s important to understand the concept of strained zones and what constitutes a large or small landlord.

The strained zones are those where rents and asking prices have risen more dramatically. They are defined by local authorities and, in order to obtain this label:

- the sum of the average cost of rent (or mortgage) plus costs of utilities should be higher than 30% of the average household income;

- the rent (or asking price for properties for sale) should have risen by at least 3% above the Consumer Price Index over the previous 5 years.

Once designated, an area is considered a strained zone for three years, and this label can be renewed depending on housing market conditions.

And when it comes to large and small landlords, there are also new definitions that will affect the rental policies applied.

A large landlord is an individual or company that owns more than ten urban residential units or a built-up area of more than 1500m2 for residential purposes (excluding garages and storage areas). But, if we’re talking about a strained zone, the limit is reduced to five properties.

Meanwhile, small landlords are those with less than 5 residential units.

Rental increases, new agreements and renewals

1. Rules for increases in existing agreements

The first thing to know about rent increases is that they are no longer linked to the Consumer Price Index. They are now limited to 2% in 2023 and 3% in 2024, with new rules for future years.

In cases where the owner is not a large landlord, the increase can be agreed between the tenant and the owner. And if no agreement is reached, the increase cannot exceed 3% of the current rent.

The same logic applies to all other agreements: they can’t override the new Housing Act.

2. Rules for new agreements

The Housing Act of 2023 establishes a cap for all new lease agreements for properties located in strained zones. The rent cannot exceed the value charged in the last lease for the same property (taking into account the last 5 years), plus the update percentage for the current year (2% for 2023, 3% for 2024).

It’s also important to note that the landlord cannot pass on to the tenant the obligation to pay any charges or expenses that were not included in the previous tenancy agreement.

Exceptionally, small landlords will be able to increase the rent by up to 10% in relation to the value last charged if, in the two years prior to the signing of the contract, the property:

- was renovated;

- has undergone improvements resulting in a 30% saving in non-renewable energy;

- has undergone accessibility improvements.

If the new contract is for 10 years or more, the 10% increase also applies.

Meanwhile, large landlords must comply with the price containment index.

Finally, properties that have never been put on the rental market must comply with the price limits set by each Autonomous Community for the first rental contract.

3. Rules for contract extension

If the landlord or tenant doesn’t give notice of the end of the contract (4 months for the owner, 2 months for the tenant), the contract is automatically renewed for one year, which can happen up to three times.If the property is located in an urban area, it’s compulsory for the landlord to accept the tenant’s request to extend the lease.

The exception is when the owner needs the property for himself or his first-degree relatives to live in, or when the couple is divorcing and has to divide the couple’s assets. In both cases, there are deadlines and rules for suspending the lease.

Tax benefits and costs to the owner

To encourage owners to put their properties on the rental market, the Housing Act provides incentives for small landlords who rent properties in strained zones at affordable prices. Landlords can receive tax relief on their net rental income at the following percentages:

- 50% reduction for new agreements;

- 60% reduction if the property has been renovated in the two years prior to signing the contract;

- 70% reduction if the property is rented to young people between the ages of 18 and 35 or as part of subsidised rental programmes;

- 90% reduction for new contracts that charge at least 5% less rent than the previous contract.

These are the main options available to owners who wish to participate in solving the housing problem, but there are a few others in the Housing Act.

As far as obligations are concerned, it’s important to understand that from now on, owners will be responsible for paying for property management services and contract fees. They will not be allowed to increase the rent to cover other costs, such as rubbish collection or community fees, and they will not be allowed to pass on to the tenant the obligation to pay the estate agent’s fees.

Finally, those who own more than four properties in the same municipality and who leave dwellings empty for more than two years can be charged an increase of up to 150% of the Impuesto sobre Bienes Inmuebles (IBI) by the local council. In other words, instead of keeping the property empty, the state wants to encourage owners to become landlords and add another property to the housing market.

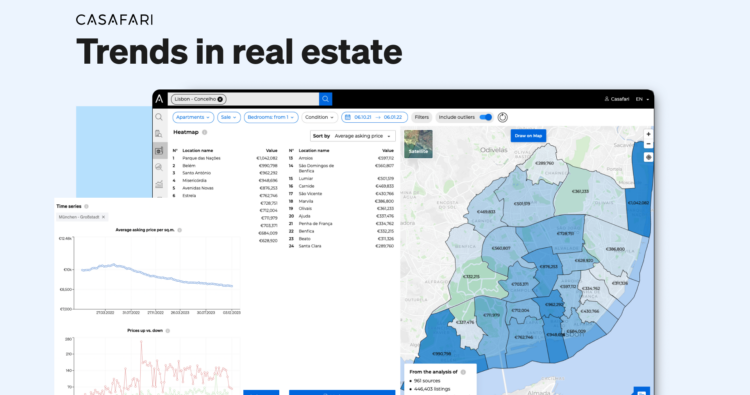

Do you still have doubts about the new Housing Act of Spain? You can check all the regulations in the Official Bulletin of Spain. And, of course, count on CASAFARI’s data to see how this new set of rules is affecting the property market in the country.