It doesn’t matter whether they do it because they can’t fund the whole property by themselves, because oftentimes rent is higher than the mortgage for a similar place or due to a combination of both factors: the fact is most buyers in Spain need to request a mortgage to pay for their property.

And, although they are willing to make this big commitment, financial institutions usually have very slow and bureaucratic processes that slow down the buying and selling of properties, which affects both the buyer and the ability of estate agents to increase their revenues.

But if most people that buy property in the country need this financial push to become homeowners, how can mortgages in Spain become something easier to access, benefitting both the population and real estate professionals?

Let’s discuss this question further and understand the vital role of Colibid in this dynamic.

How often do homebuyers resort to mortgages in Spain?

The short answer to this question is: very often! Data from the Spanish National Institute of Statistics (INE) estimates around 30,000 mortgages in Spain being accepted monthly and indicates that 136,000 of these agreements were signed until April in the year of 2023.

Until the same month, 3.704,78 million euros had been lended in mortgages, with the highest number of requests coming from the regions of Aragón, Islas Canarias, Comunidad Valenciana and Asturias.

This monthly number of requests is affected by the market’s purchasing capacity, the supply and demand curve for properties available on the market and by fluctuations in rent prices. Lately, the rise in the Euribor rate also heavily influenced a decrease of mortgages in the country, since within a few months the interest for fixed mortgages has risen to 4%, instead of the previous value of 1.5%.

Despite the aggravated pressures over the mortgage borrowers, the number of foreclosures has decreased significantly over the last 10 years. During the first trimester of 2023, only 5.168 mortgages in Spain went through this process, a number that represents a contraction of 39,4% in relation to the same period of 2022.

These people are keeping up with their intention of buying their properties despite hardships, which sounds like one more reason why Colibid is needed: it was about time we changed this scenario for both real estate professionals and mortgage borrowers!

Colibid and the democratisation of the access to mortgages in Spain

In January 2022, only 3 months after its founders met, Colibid was born: a mortgage solution that speeds up the process of requesting and signing a mortgage. Their very first auction happened that day, making financial institutions compete to offer the best offer for the borrower.

Their goal was clear: offer a fairer and faster way to get mortgages in Spain, giving borrowers their bargaining power back and allowing them to access the best mortgage rates, all of it through a fully digital, free and safe service.

The mortgage deals are done through a simple process that begins with the borrower creating a financial profile that will be shown to banks and brokers. After that, a 3-day auction takes place, in which the institutions will compete, bidding and improving their conditions to try to be picked by the customer.

And, in order to ensure that the borrower profits from the platform, Colibid also provides training and content that educates them about their rights and responsibilities during the mortgage process.

A year and a half, their business has grown exponentially, proof that their mortgage solution was something needed by the Spanish property market. Now, they count with the largest portfolio of banks and brokers nationwide, all certified by the Bank of Spain, and, in such a short period of time, Colibid was able to manage nothing less than 27,000 auctions.

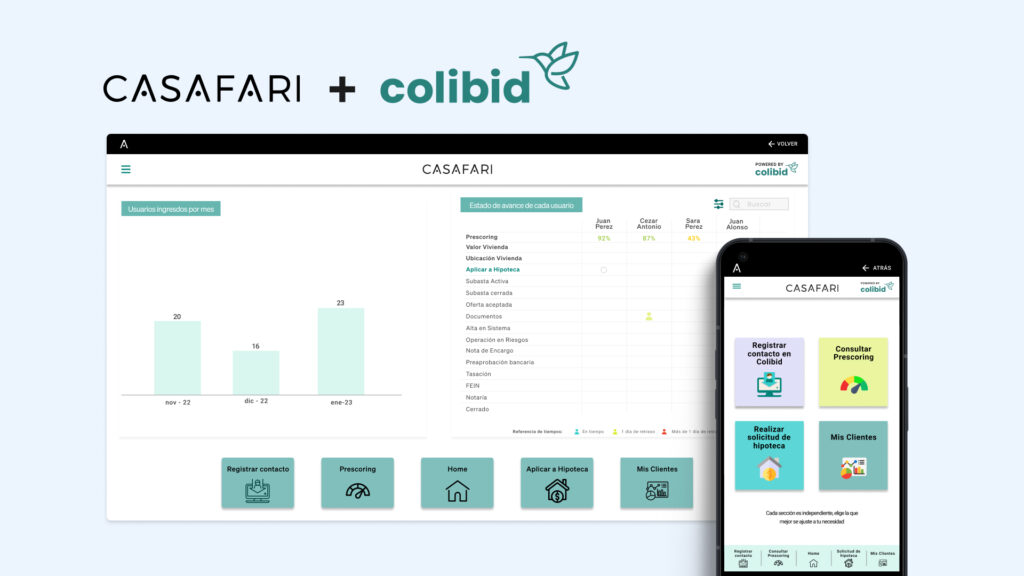

CASAFARI & Colibid: a partnership that speeds up the process of requesting mortgages from both ends

In Colibid, we know that many borrowers request mortgages through estate agents. And, more importantly, these agents are also interested in speeding up their sales by having faster mortgage processes. So, we thought, why not provide these professionals with an easy way of accessing our platform?

That’s when we knew we needed to partner with CASAFARI. By having direct access to Colibid inside CASAFARI, real estate professionals can offer better mortgage rates for their clients with minimal diversion from their everyday tasks. They’ll be able to create their client’s profile, check their prescoring, apply for a mortgage and check the status of their process, all within the same platform.

A mortgage solution to facilitate sales in Spain: the partnership between CASAFARI and Colibid

If it makes the lives of real estate professionals easier, it helps them provide better services to their clients as well, which is a shared interest of Colibid and CASAFARI.

Now that you know that there is a much faster and better way to get mortgages in Spain, what about providing it as part of your services? Waste no more time and find the best mortgage rates for your clients in no time by accessing Colibid through CASAFARI.