You found a few investment properties, negotiated prices and successfully bought them. Shall we talk about how to manage your property portfolio, then? Here are a few things to consider if you want to make sure your investment was worth it and that you can smoothly keep them bringing desirable yields.

Run a property valuation at least once a year

Keeping your investment properties rented is vital to secure your yields, but, in order to do so, you will need to keep a close eye on the market movements. Property investors need to be aware if their properties are increasing or decreasing in value, as well as understand if the rent they are charging is in line with what’s currently practised in the market.

Why is that important? Because it will help you make informed decisions about raising the rent to ensure maximum profitability or decrease it to avoid vacancies. Appropriate prices will avoid putting your properties at a disadvantage in relation to others that are similar, keeping the tenants with you instead of seeing them leave sooner than expected.

CASAFARI’s Property Valuation will help you find the properties that compete against yours on the market, based on similar characteristics and location. It also takes these comparables into consideration to provide a fair market value for your investment property, that’s aligned with how the market is behaving at the moment.

Looking for an online property valuation that’s trustworthy and done in seconds?

Project accurate vacancy assumptions

Another relevant information to have at hand is about how many days a property such as yours usually spends on the market. This is useful to project accurately how many days your property would be vacant once put to rent or when a tenant decides to break the lease contract.

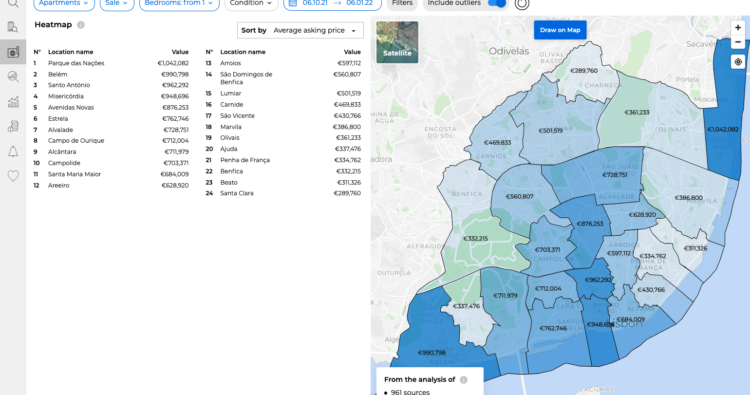

This can be done by looking at the days spent on the market on CASAFARI Market Analytics, a tool that shows you the property market trends.

CASAFARI Market Analytics: follow the property market trends

Preparing to have tenants

Choosing tenants is a tricky task because you want to make sure that they will not bother the neighbours, they will live according to the rules of the building and they will pay the rent in a timely manner.

In order to conduct an appropriate screening of potential renters, come up with a tenant scoring system that takes into account all the criteria that’s relevant to you, such as their financial situation or if their family configuration matches with the property.

Also, research what types of insurance the market offers to property investors. Understand which of them are relevant to have (especially those that protect you from expenses with electrical damage, floods, fire, etc.) and if there is any that is compulsory.

Stay on top of what’s happening in the local market

In order to manage your property portfolio, another important subject are the property market trends and how they’re affecting your real estate. You should keep an eye out for:

- How many properties such as yours are available (are they common or not?);

- If the prices of these properties are increasing or decreasing;

- How fast are they being sold or rented;

- If they are becoming more sought after or less.

Real estate asset management for property investors with CASAFARI

This will help you read the environment and make accurate assumptions about what you should do with your investment property. For example, you will be able to understand whether it’s a good moment to sell a piece of real estate or not or even whether you could raise the rent or not.

Keep yourself organised

Taking care of your property investments means dealing with a considerable amount of bureaucracy and paperwork. So, it’s important that you stay organised and map the most important information for your business. Here are a few topics for you to keep track:

- Create and update rent roll, for you to have clarity about who are the tenants of each of your investment properties and when are the rents due;

- Gather in a folder all the lease agreements of your properties;

- Keep track of when lease contracts start, when are they due and when they should be renewed;

- Add to your calendar when to collect rents from all properties.

Having all this information easily accessible will help you notice once you need to take action.

Create a good network of providers

If you invest in the property market, one thing is for sure: at some point, all property investors need to deal with maintenance. This is especially true if you bought properties in older buildings.

In order to make this easier for you, stay ahead of the game by having at hand a number of competent professionals, such as plumbers, construction workers or local companies that could help with smaller repairs.

You should look for professionals with good recommendations to make sure any problems that might come up are effectively solved, avoiding keeping your property empty for long, bringing constant inconvenience to tenants and generating recurring expenses to you.

Also, this helps you keep a good relationship with tenants, which makes them stay and ensures the profitability of your investment properties.

Another good idea is to have the contact of property managers in the buildings in which you have assets, in order to get in touch with them when something goes wrong that affects your properties.

Feeling a bit overwhelmed? Worry not, CASAFARI has the ideal tools to help you throughout this process to make sure you manage your property portfolio based on data-driven decisions. Waste no time and subscribe!