Did you know that an asking price that was mispriced can damage the image of the property, make the sale process harder, leave the owner uncomfortable about selling their property or even make your seller client lose money?

Understand how relevant is having the appropriate asking price for real estate and how easy it can be to find them.

1. The appropriate asking price makes the property sell faster

Imagine that you have a property to sell, but it’s currently overpriced. The first consequence for a mispriced real estate is that many potential buyers will skip booking visits. You know why?

Because if the asking price is too high for their means and in relation to other available properties, they’ll turn to see what’s out there instead of trying to negotiate a better price. And, if the opposite is true and the price is too low, they’ll probably think there’s something wrong with your property.

What’s worse is that, after some time marinating on the market, it will start to be seen as problematic – which makes it even harder for you to sell! You’ve probably experienced something similar when buying property for a client, right?

When you run an online property valuation and set the appropriate asking price for a property, you position it accordingly to the market. Hence, it will start to be seen as a hot offer, attracting more visitors, making it more competitive and increasing the chances of a faster sale.

New: HOT OFFER labels and scores for the best market opportunities

2. It helps settle expectations about a deal

Whether it’s for emotional ties to the property or to increase the ROI of their business, more often than not the client will want to sell their property for the highest price possible.

When you have a property valuation report that allows you to show your client which factors were taken into consideration when deciding for the asking price of a property and how the market is at the moment, you are able to settle their expectations. From that moment on, their mindset will start to work with actual figures, instead of wishful thinking.

3. Helps strategise for a potential negotiation

Another point about having a clear understanding of the asking price of a property is being able to define which margin you have to negotiate. This works for many situations.

When it comes to changing the price of a listing, if the property is overpriced, by finding the appropriate pricing you know exactly how much you should try to decrease when negotiating with the seller client. On the other hand, if the property is underpriced, it helps you show the owner how much they are losing by not increasing the asking price.

You can also add a percentage of the total value to the asking price, that will serve as your negotiation margin. This way, if a homebuyer is interested in the property, you already have in mind how much you can decrease the price in order to seal the deal faster.

There will be no need to ask for your client’s permission, speeding up the sale process, while still making sure your client is getting an amount out of the deal that’s appropriate for the property. And the same goes for rent, of course.

Property valuation report: how to find the appropriate pricing for a property

There are a lot of factors to consider when defining the right asking price for a property. For example, you have to think about how good the location is, how well maintained is the property, how is the demand for real estate such as the one you have to offer on the local market and much more.

This is why using a property valuation calculator is something that can save a lot of time and effort from the estate agent.

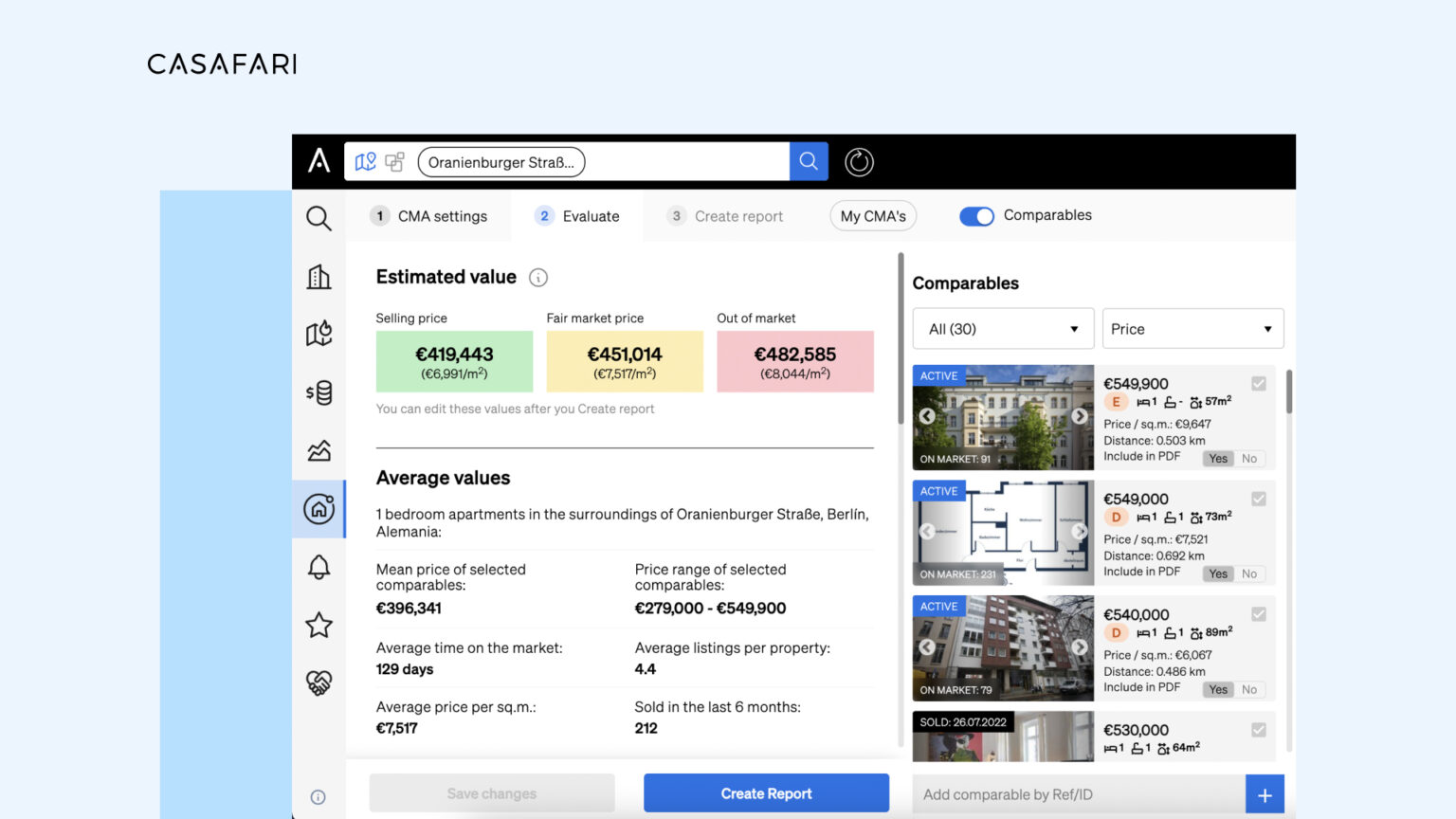

CASAFARI’s Property Valuation, our property valuation tool, compares your property to others in the same location and with similar characteristics to find the most accurate asking price possible. This is particularly relevant to make sure you’re basing your pricing strategy on what’s actually going on in the market, instead of in assumptions or in past experiences.

Property valuation: easily find the competitors of your properties

But, more than that, our property valuation report also provides you with information that you can use to justify to the owner your choice for a specific asking price, as well as to explain to them how the market is behaving at the moment for properties such as the one you’re selling.

The report will show you:

- A suggestion of asking price for sale or rent;

- An analysis of similar properties;

- The average time spent on the market for properties such the one you’re selling;

- Points of interest around the property that might affect the pricing;

- Which are the competitor properties on the market and for how much they’re being sold or rented;

- Graphs showing the evolution of prices and price distribution for properties such as yours.

All of it is done in a few minutes and it can be accessed through a PDF or a smartlink, making it easy for you to share with clients. Amazing, right?

New customisation options for your property valuation report

Stop wasting hours in search for the information you need to come up with a pricing strategy – let technology work in your favour instead! Subscribe now to use CASAFARI’s property valuation calculator, a tool that will boost your business with the appropriate asking price to your sales.