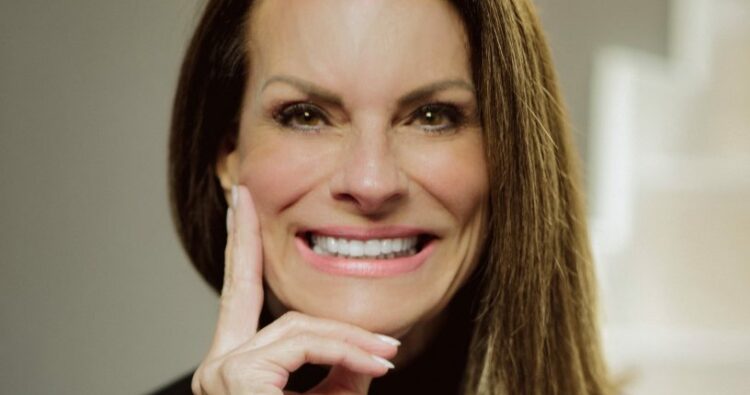

Hugo Ferreira has presided the Portuguese Association of Real Estate Developers and Investors (APPII) since May 2021, as a result of the largest vote ever, elected with an absolute majority.

In this interview, Hugo Ferreira talks about the recent changes in the Portuguese property market, promoted by APPII, passing through the new projects created by the institution and how he sees the future of the sector and of the Association.

You were recently elected president of the APPII, in the largest vote ever and with an absolute majority. What would you like to leave as a mark on the Association until 2024?

Since the post financial crisis, the property market has been evolving and always positive. It has come through the pandemic well. Despite everything, the real estate sector has never stopped. In fact, the Bank of Portugal has referred to it as one of the most resilient sectors. We are very capable of being the first to move forward because it really is a boat that has never stopped and there is not so much friction when starting activities.

However, this does not make it any less challenging. We have a global economic recovery to make, with major commitments at European level, essentially in terms of the environment and, therefore, we have the so-called European Ecological Pact, the European Green Deal itself, which, in fact, is where our national RRP (Recovery and Resilience Plan) will largely come from. I would say that we have, despite the good times, very big challenges ahead. And some even with very tight metrics and targets.

For example, one of our goals is to paint real estate green. Since the new European directives and the Green Deal itself, we have until 2050 and even a shorter deadline, until 2030, to transform our buildings into “N0”, Near Zero Energy Buildings.

It is a commitment that is going to require a lot from all of us, not just from the industry, but from our governors, all businesses and people, because 2030 is tomorrow. Nine years are very tight targets, in an activity like real estate, especially in the area of property development, where activities are seen in 5, 10, 15, 20 years.

I wonder if this goal is realistic and if we are to take it seriously, because, if on the one hand I think we all have this commitment and are committed to it, on the other hand, mainly on the side of public entities, nothing is being done. I’m not just talking from a fiscal point of view, but also from a financial and legislative point of view.

Another goal, I would say, is to make real estate healthy. That was a product of the pandemic. For many years we talked about environmental sustainability, but there is another very important sustainability, which is human sustainability. And the pandemic brought us that: every day people died, and often when we talked about sustainability, I think we forgot to talk about ours. If we look at buildings as the biggest source of contact with human beings, I would say that they are one of the main agents of public health.

That’s how, in the middle of the pandemic, we launched a platform together with a medical university in Portugal, NOVA Medical School, and launched what we called Living Lab APPII Real Estate Health, which is a platform to exponentiate medical scientific knowledge to companies, to life and to civil society, and, at the end of it all, to be able to qualify healthy buildings for health. We’ve already done it with residential buildings and in offices, and I think that’s also one of the big challenges.

In your point of view, what is, in practice, an example of a healthy and an unhealthy building?

We have the certification that we call Healthy Building: a qualification given by experts and doctors from NOVA Medical School, who enter the project with the architects and designers of the real estate developer, where they will give indications on how a project should be done.

I can give you some examples: to greatly enhance the use of wider, pleasant, beautiful staircases, which are easy to use, with wider spans, wider, so that there is less contact between people. Also, measures in terms of energy efficiency, with the use of materials that we consider to be healthy, not only for the environment, but above all for health.

I would say that the qualification of a healthy building will have, necessarily, a lot of what is environmental sustainability, besides more components at the level of the use of spaces, whether in a residential building or an office, logistics or hotel building.

Here is where the humanisation of buildings comes in?

Yes! Portugal has done a fantastic job in that area, in terms of urban regeneration, in recent years. I think we still have a lot to rehabilitate, but that’s the aesthetic part, the building part. We needed to humanise our buildings and make them more friendly to those who live or work in them, but also green, complying with those very tight metrics.

Above all, it doesn’t worry me so much in the higher segments of residential real estate because I think it is building very well. Portugal is known in Europe as one of the countries with the best construction. For example, if you compare it to our Spanish neighbours, our construction is significantly better.

But, on top of all that, I think we should try to bring here the fight for greener real estate, making the whole chain from construction to use, complying with everything that the European Union demands of us to protect planet Earth.

You recently launched APPII Community, what do you expect from this sharing hub?

The APPII association is not only the voice of the sector, it is a unique and privileged point of contact for all real estate professionals who revolve around property development and investment. It made sense to take a step forward and create what is so fashionable today, the communities.

It is a term that is used as much as coworkings or colivings, which we have become used to hearing a lot recently. I really wanted the association, besides everything else, to be that, a unique contact point, privileged and, nowadays, digital.

It’s not only the meetings that we do a lot of between associates, but really the good atmosphere within the association: the proximity, the interaction, the understanding and, above all, something that I have always seen and am glad to see happening, the lively sharing of knowledge, ideas, business.

A few years ago we did the APPII Networking Trips, basically to create community. They were aimed at property developers, who often had “opposite sides”. We were able to get property developers to invite other developers, our members and partners, and to visit their developments, whether they are in the final stages, under construction or finished. We created this in 2016, and we’ve done a number of them. Furthermore, we have already visited several properties, several material industries that are our partners, many new and rehabilitated properties.

Our market isn’t exactly big, and I was amazed how people didn’t know each other. I think that’s how this seed of the APPII Community came about, which is a digital meeting point where people can connect. That’s basically it, making it a living centre for exchanging ideas and, if possible, doing business too, because that’s what we’re here for.

What paradigm shift has there been in these relationships, which previously did not mesh, since the networks in 2017?

The APPII has done a lot to unify the sector. In fact, I have defended that associations only exist when the people themselves feel the associations. I was not from the associative world, I was a lawyer by profession. When I was outside and looked at the world of associativism I saw a little bit of this, that sometimes people did not understand what the associations were for. Associations have to be a plus in people’s activities: they have to feel that we exist and that we do something for them.

The truth is that, while we see others closing their doors, we have been growing every day since 2014. There hasn’t been a single year, even in a pandemic, that we haven’t grown. I think this is the result of this young, different vision that the APPII brought to the middle of associations: not only to be a plus in the activity of the members, but to make the members unite around the association and among themselves.

Many people ask me why in Portugal there is no Mergers & Acquisitions market in real estate. I always say that it is a very small market, very limited, which could favour some M&A even to gain scale, but the main reason is because people didn’t know each other, that is the truth.

And I believe that an evolved, thriving sector is a sector with dynamic M&A, which we see, for example, in Spain. In Portugal, I think this has not happened yet. I know there are several attempts, but it does not exist yet. This is the evolution APPII Community can take.

What values does the APPII have? Have they changed since its creation or remain the same?

The values have always been the same, also because this association has something very interesting, an ephemera that cannot be identified in many others. It is a young association, it is 30 years old, and its founders are still alive. There is only one who is not alive, Joaquim Silveira, who founded the SIL group, but all the others are alive: Henrique de Polignac de Barros, Miguel Pais do Amaral, André Jordan, Stefano Saviotti.

The Board of Directors and I have tried to understand why these businessmen created the association. Really, at that time they were visionaries. Thirty years ago, in 1991, they created the association not as an “immediate thing”, but as a long-term path.

It is very funny to see that from the beginning, the APPII was founded on two basic principles. One was to be a representative association of property developers. At the time, the figure of the property developer didn’t exist in Portugal, there was the figure of the builder.

Basically, the property developers were businessmen that could even be connected to other areas, they were not necessarily people from the construction sector, which was the difference for the builder. They were economists, successful businessmen, such as Miguel Pais do Amaral, who is not a man connected to pure and simple real estate, but a man connected to the media, to the financial system. For example, André Jordan and Stefano Saviotti, people linked to the hotel business, were not real estate people per se. Or Henrique de Polignac de Barros himself, who was an economist.

Basically, they were people who were doing something that nowadays is called property development, at the time it was called real estate development.

The association was set up to represent this type of businessperson, but also to be the gateway for international investors into Portugal. Today, 30 years later, we are exactly that.

Where have we evolved a lot? Initially we were very focused on residential and today we are a national association, from north to south of the country and autonomous regions, in all market segments. We have grown a lot in the commercial area, offices, hotels, logistics, and this is something that was not so long ago, about 10 years.

We have also been the gateway for investors. This has been one of the founding principles of our existence. Today it is a reality, and we have 50% of our members as purely foreign companies. We are considered from an international point of view. Half of the associates being international is a very big weight in a Portuguese association, in such a short property market.

What was done here mirrored outside and the interest in promoting these values was mutual?

We are a very small market and the vast majority of real estate development projects in Portugal are carried out with foreign capital, not with Portuguese capital. In fact, you can count on one hand the companies that work exclusively with Portuguese capital.

A property market that is modern, globalised, international, dynamic, attractive to investors, national or international, can only exist by combining two aspects: Portuguese investment and capital, which, as I say, is scarce and short, and international investment.

Let’s look at urban regeneration in cities, it wasn’t carried out with national capital. It was done with international capital, with tourists and foreigners. Therefore, I sometimes refute the criticism that the association should be completely nationalist, that it should oppose international investors, a little bit with a long-term vision against a vision that I think is short term.

I think we will all win if we have an international, globalised, dynamic and diverse property market, because we are very small and, unfortunately, a poor country that cannot afford to waste foreign capital.

As we conquer the “new normal”, how do you think the property market will react from now on?

We never stopped, we were resilient. We will certainly be the first to return to normal, as a sector of activity. I’m not a “catastrophist”, it’s not going to be completely different. It’s going to be the same world, with small evolutions and changes. This will be seen a lot, for example, in the residential sector.

Perhaps a turning point because what we were seeing was a lot of demand, naturally due to high prices, for smaller properties, even excluding exterior space. This was very evident in the pre-pandemic. I think the big difference will be in terms of space.

In the post-pandemic, and it is already happening, I think that more outdoor spaces will be looked for, green spaces, we will go back to having the famous T4, T5 and T6, which didn’t exist. Everything was done T0, T1, T2, T3. It was very rare to have a T4. I think we are going back to that reality, just like the offices inside the house. Because we all lived 18 months inside the same space where we had the dining room, which became an office. The “office” division will come back.

The outlook in terms of market evolution is quite positive. We don’t foresee any major changes and I am convinced that in the next 2 years we will be able to resume pre-pandemic investments.

Therefore, our outlook is quite optimistic and I am convinced that real estate will continue to be a real estate refuge, where all that is international and national investment, especially the latter, will place their capital because the pandemic itself has generated an excess of international liquidity.

The central banks, European and worldwide, did nothing else in the pandemic than inject liquidity into the economy to avoid the risk of economic recession. Which means that those who had money more than doubled it. With money, the only thing you can’t do is to have it lying around, it has to be allocated, invested.

And, in fact, with the climate of low interest rates that we are experiencing, a drastic evolution is not expected in the short term.

Then, the fantastic country that we are, which speaks several languages, with a fantastic welcoming, beautiful beaches, 1000 km of coastline, 900 years of history, which has the programmes that are still managing to attract foreign events, and above all which has real estate that gives good returns, good yields – in fact, with the pandemic, prices continued to rise -, basically, this is what an investor is looking for.

I don’t agree with those who say that this will bring more people to the interior. It would be very strange if that happened because it would go against a social phenomenon that has been happening for decades, which is the attraction to urban centres. Above all, it happens for reasons of employment and quality of life. I think that more suburban areas have been sought after.

In terms of offices, perhaps it was the segment where there was more suspension in the pandemic, because we were moving towards a coworking environment, of open spaces and community. If we couple this with the concept of telecommuting, we’re going to see companies enacting a few days a week in remote, others even enacting almost full-time telecommuting. I think we’re going to see a significant change in spaces. Not that there’s going to be less sought after area, but these are going to convert and therefore have different uses within the office.

Then, there is a very interesting phenomenon, which has to do with the evolution of telework itself and with the improvement of people’s quality of life. That is, companies will keep their headquarters in city centres, where they have always been. But, to avoid the arrival of many workers who live in suburban regions of those areas, what I think will happen is that companies with some dimension will make small surveys to their workers and will see where they live and eventually create small hubs.

As we can’t have everything at home, in that hub, people’s needs will be located and, therefore, photocopiers, receptionists, meeting rooms, and people won’t have to go to the headquarter. I think that this is a phenomenon that will happen and that was also very much related with the dynamisation of telework.

Then there is logistics, which I have called “the pandemic sector”. It was the logistics sector that during the pandemic went from being a completely stagnant sector to one of the most dynamic sectors. VGP Parks, one of the largest logistics operators in Europe, has since been opened.

Therefore, as you can see, logistics became a highly dynamic sector, very much driven by the so-called last mile, a logic of proximity. As the pandemic greatly increased online sales, it showed that the system that was set up in terms of logistics did not work for such a case.

We are currently in contact with one of the world’s main operators in terms of logistics in the association, with whom we are working to develop large industrial parks, very much in the last mile perspective, in Portugal, even because we live on the edge of Europe, which makes this location a strategic point.

And the hotel industry, which we cannot fail to mention. It will be a return to normality. We must wait for people to gain confidence to travel and, when they do, everything will return to normal.

About Coworking, coliving, cohousing and senior living, this last one will remain and therefore the growth will be as normal. I would say that in coliving and coworking we have to see how they progress. I think that coliving has slowed down a little bit because we are seeing where this is going and the needs may be different.I think quickly the alternatives will stop being alternatives and become a standard form of residential or office, although now there has been some suspension. Here’s where I think there’s going to be a big change.

Any news in the pipeline about the Association?

I have something new that I can tell you about: the APPII Academy, which was a very old desire of mine because training is in fact essential. It is a market that I want to be professionalized and evolved and that is available to be globalized and international.

Our idea is to have various courses available to our associates, very much in a perspective of executive training, whether in the financial and legal areas, among others. Basically, it is to give a lot of training to our managers, to our CEOs, to our directors of associated companies.

Therefore, we decided that the first training that the APPII Academy will give is one on money laundering and terrorism financing because it has clear obligations, which, if they are known and well introduced, are easy to understand. It is a very important area in our real estate sector, and although it is very important and mandatory, there is a great lack of knowledge in the sector. I have said this publicly and alerted not only the public entities, such as IMPIC, which is the regulatory agency, but also the governmental entities that, due to a chaotic legislative process, have caused a huge lack of knowledge.

We invited Dr. Pedro Coimbra, who is the former inspector of IMPIC, one of the people who best knows the laws on money laundering in our country, to be one of the trainers, and Miguel Trindade Rocha, ex-Ernest&Young, who has now launched his activity more intensely in the area of money laundering. I think they are two of the people who know most about money laundering in Portugal in relation to real estate.

We intend to give a course on healthy building, in partnership with NOVA Medical School. In fact, this has already been discussed, and we would like to train the real estate sector and our associates in particular in healthy building.

In addition to these executive courses I mentioned, we want to do one on real estate investment funds. I think this is an area that deserves to be explored in greater depth and, therefore, these will be the next courses that we will work to put into practice.

Who is Hugo Ferreira and how did he end up in real estate, when his background is in law?

Above all, I am a very practical person, who likes to do things, to leave a mark on this world and on life. I am in a position to leave a mark in the real estate sector with my team, the Board of Directors and the governing bodies that I have chosen to be close to me.

I think we have taken this path in a very responsible and solid way. After all, it’s not just about making a mark and then leaving tomorrow. When we leave, may we be remembered for having left a solid, responsible mark and may the Association be here for the next 30 years. I received the association when it was 30 years old and I want it to be even better 30 years from now.

I am an ambitious person and there is no need to be afraid to say that. Having ambition only makes us move forward. But ambition with criteria, with respect for others. I think we should be proud of what we do and I am very proud of what we have done in the association.