CasaFund was a real estate investment vehicle launched by CASAFARI, designed to showcase how to use Casafari data to get alpha returns in real estate by capitalizing on underpriced SFR (single-family residential) properties strategically located in Lisbon’s prime city center. Over a two-year acquisition period from Q4 2020 to Q1 2022, CasaFund assembled a portfolio of 38 premium residential assets with gross yields close to 7% unlevered and vacancy rates close to zero.

These assets were converted from short to mid-term/long-term rentals. CasaFund’s objective was to maximize returns for its investors by building a crisis-proof long-term rental portfolio in Lisbon’s sought-after neighborhoods.

The idea attracted the interest of 30 private investors and family offices and was managed by CASAFARI’s dedicated team of market experts, who handled all operational aspects of the project.

A data-driven approach to buying and managing property

CasaFund’s approach combined in-depth market insights with data-centric decision-making to optimize the timing and conditions of each acquisition, rental, and sale.

When it came to finding the ideal properties for investment, the team turned to CASAFARI, the largest real estate database in Europe. Our Property Sourcing was used to find the best opportunities with the desired characteristics, such as a determined estimated rental yield, location, and price. Additionally, Alerts were created to notify the CasaFund team of new interesting properties that were available or sequential price decreases indicating high interest to sell.

To ensure that the capital was well-invested, our Property Valuation was used to analyze the accurate value of the assets, comparing it to similar properties on the market. This resulted in decreases from the asking prices to closing prices of up to 30%.

Once acquired, CasaFund meticulously managed each property, overseeing the full investment cycle to maximize returns. This comprehensive approach included defining competitive rental values, coordinating refurbishments, sourcing tenants, and ensuring effective property management until the time was right for a sale. By leveraging CASAFARI’s vast market data, CasaFund identified precisely where CAPEX (asset upgrade through refurbishment) could add significant value with a positive ROI (return on investment), ensuring property price and quality would become more attractive to both tenants and future buyers.

In addition to Property Valuations, CASAFARI’s Market Analytics tool played an essential role here, helping the team monitor market dynamics and make timely rent adjustments that aligned with prevailing trends. This attention to market movements allowed CasaFund to maintain optimal rental income and consistently boost the portfolio’s overall ROI.

Moreover, when it came to selling the portfolio, it was only logical that Property Valuation was used once again to determine the most actual and accurate price of each asset and utilizing our market access to 60,000 real estate agents for an accelerated sale unit-by-unit.

A closer look at use cases and returns

To illustrate the success of CasaFund, here are three representative use cases showcasing how carefully selected properties generated substantial returns:

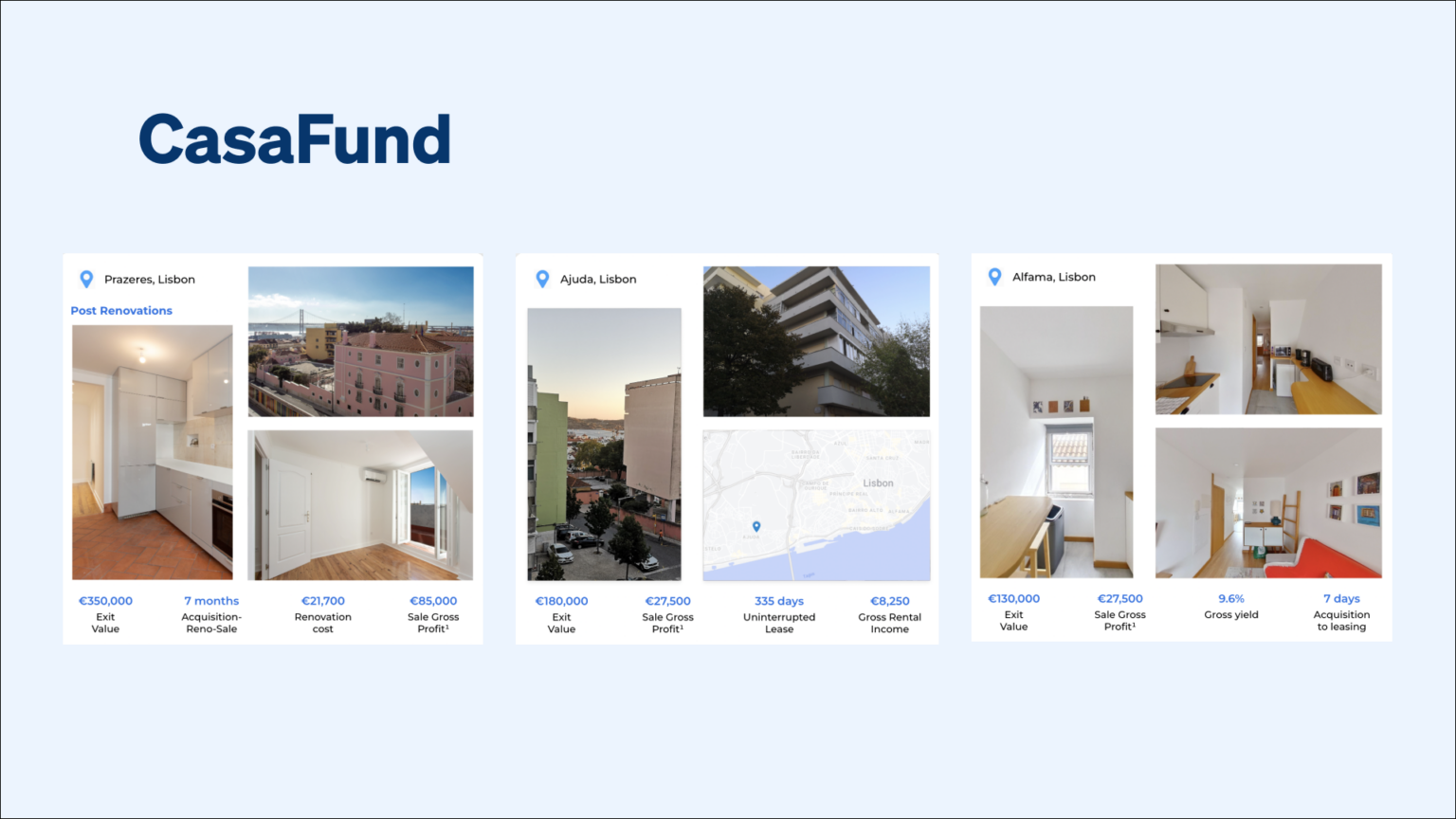

- Prazeres: Capitalising on Unique Features

In the Prazeres neighborhood, CasaFund invested in a spacious 120 sqm, 3-bedroom apartment with a remarkable view. Purchased at €235,000 and renovated for €21,700, this apartment’s appeal attracted high buying interest, enabling its sale just seven months later for €350,000. This generated a gross profit of €85,000, allowing CasaFund investors to capture the market’s upside and reinvest the gains into new acquisitions.

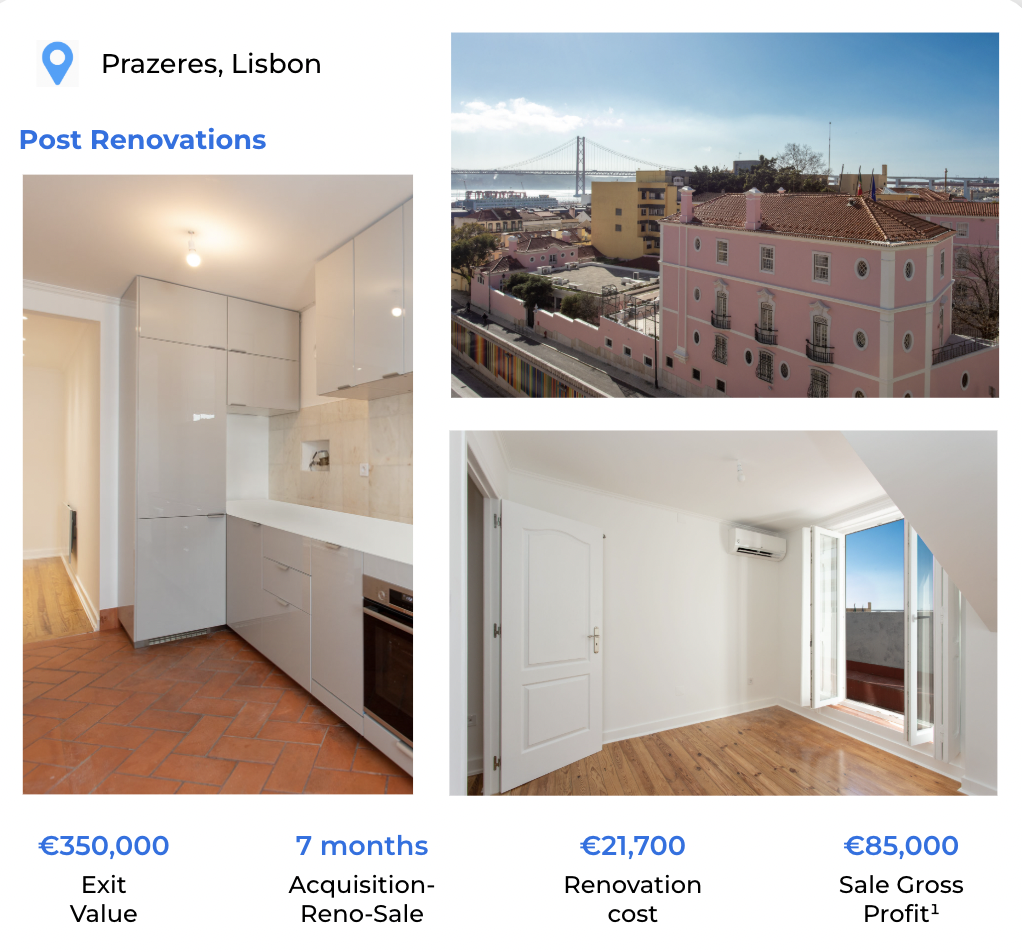

- Ajuda: Leveraging Existing Lease Agreements

CasaFund also identified a discounted 40 sqm, 1-bedroom apartment in Ajuda, purchased for €150,000 with an existing lease agreement. Within a year, the combined returns from the sale and lease proceeds exceeded €35,000, underscoring the value of acquiring properties with established rental income streams.

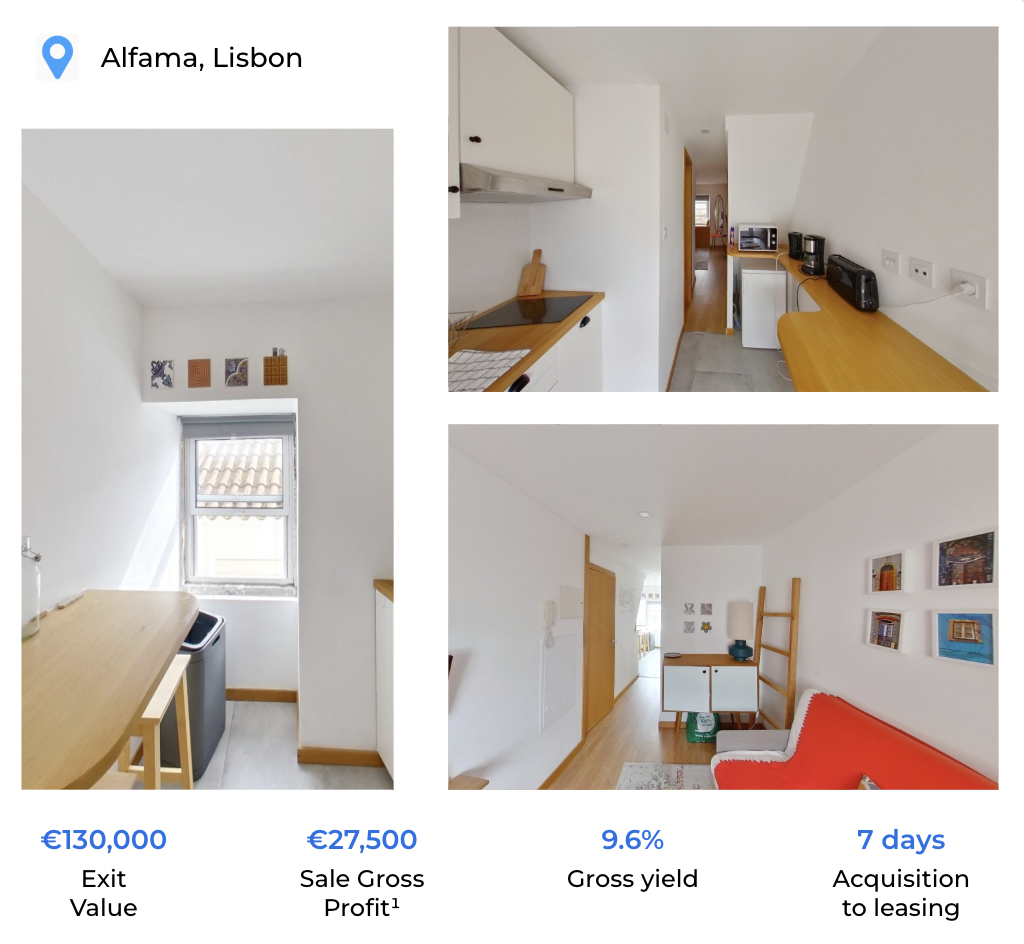

- Alfama: Maximising Yield on Assets

A 30 sqm studio apartment in the Alfama neighborhood was another profitable investment. Bought for €100,000, this asset generated a robust gross yield of nearly 10% before being sold at an exit value of €130,000.

With cases like these, CasaFund significantly outperformed any REITs or other real estate investments during 2023-2024, a significant accomplishment given the economic challenges during its operational period. Despite the market downturn, with property prices experiencing corrections and interest rates spiking, CasaFund managed to secure an overall positive net exit profit for its investors.

Property appreciation varied, with some assets generating exit net profits of +20% or even +30%, illustrating the fund’s ability to capture significant returns in select cases. This resilience highlights the effectiveness of CasaFund’s strategy and the value of investing with precise market insights.

A key factor behind CasaFund’s success was CASAFARI’s advanced data tools, which guided every investment decision. They allowed the team to assess each property’s history and analyze past price trends, enabling informed purchase decisions. Additionally, CASAFARI’s technology tracked real-time market changes faster than others in identifying prime buying and selling opportunities based on current stock and pricing.

In simple terms, working with data and innovative technology, CasaFund managed the impossible: while everyone else lost money in real estate during the same period, those who invested with CASAFARI’s technology earned money, even in challenging times.

CasaFund demonstrated the potential for targeted real estate investments in dynamic urban markets, showcasing not only CASAFARI’s expertise in the real estate sector but also leading to a remarkable conclusion: those who buy property based on data can outperform the market during any economic cycle.