A few years ago, Marc decided to invest in Spanish property. A businessman by nature, he tackled this endeavour along the lines of “The profit lies in purchasing”.

After a few months, he found something suitable on one of the many Spanish classified websites. A local real estate agent listed the building (a complex of several apartments and a restaurant) only in the Spanish language. The paradox was that the property owners were German. It took a Spanish estate agent to sell the property from Germans to a Brit.

When Marc asked for basic information, such as the average price per square meter in the area and the development of the market, the realtor looked at him and said: “The sun shines all day and you have the sea at your feet. Isn’t this enough?”

Property Investments Depend on Data

In order to know where to invest, one needs to have accurate insights of the property market. These insights start with data, but finding clean public numbers is a Sisyphean task. Most of them are useless as they are either outdated or distorted due to duplicate listings and the inclusion of outliers.

Duplicate listings are properties which are listed by several agencies. One property can be listed by up to 35 different agencies with 46% average deviation in the price. When we are talking about the prime property market, this translates into differences of 23 million Euros for the same property.

As a logical consequence, duplicates and outliers have to be excluded from the dataset; the latest and true price has to be found out.

Additionally, public data is too general for property investment purposes. They consider anything from one-bedroom apartments at the highway, over commercial properties to luxury villas. This is like asking a car dealer for the number of “Bentleys” he sold this month and receiving the number of all sold vehicles in total.

So how can you obtain the correct data?

Data: A most invaluable source to predict the future. Photo by justgrimes via Flickr

Artificial Intelligence Improves the Property Market

The rapid progress of technology which we witness right now affects traditional markets. No matter if they are simply getting innovated (Uber) or even disrupted (Airbnb), the tech-induced change is taking place.

This technological progress found its way to the real estate world and was coined as “Proptech”, a neologism which refers to the simplification of real estate transactions with the help of technology.

Remy Raisner wrote for the Huffington Post that “PropTech has the potential to experience the traction FinTech created at its inception, if not more. Exciting times are ahead…[] At the top of the list is Artificial Intelligence (AI), which could lead to AI assisted property managers, real estate brokers, lawyers and even asset managers and businessmen.”

While “AI-assisted” sounds like there is a robot standing next to you helping with the dishes or walking the dog, let’s start with algorithms.

The Science Behind It

An algorithm is nothing more than telling a computer how to solve a problem. Let’s say you want to have a program that tells you whether a number is a natural number or not.

The (simplified) way to tell the computer how to execute this program is to give it two instructions. First, if the number is equal or greater than 0, print “Yes, it is a natural number”. Second, if the inserted number is smaller than 0, the program should print “No, it is not a natural number.”

Machine Learning, a form of AI, enables computers to execute tasks which are too complex for the human brain. We have the data, we know which result we want to have, but we don’t know the single steps because the data is simply too big.

To become a master of chess, for example, it takes ten years of practicing and reading books. If you give a computer the last hundred chess games (all the turns the players did, as well as the information of who has won), within one week the machine will be better than the chess masters. The AI-machine will play thousands of game sessions with itself, testing different tactics, failing and learning from failures faster than any human could ever do.

Within one week the computer will beat a human being mastering the game for decades. Photo by Alan Levine via Flickr

How Machine Learning Helps You Finding Properties to Invest In

Applied to real estate data, this means that it is possible to develop an artificial intelligence which outperforms humans in tracking the entire web for real estate data, no matter how chaotic it is. Artificial intelligence bots extract and clean property data, match duplicate listings and analyze the market without someone lifting a finger.

If this still sounds ambiguous, imagine a search engine like Google. The major difference is that this one only targets real estate related information and arranges it for your intentional use in a neat way.

Are you looking for underpriced properties to renovate with a sea view in a prime location? No problem, the machine will be able to classify this type and find the best deal as soon as the property comes to the market. It will instantly calculate the return on investment (ROI) based on the best past rental and selling prices.

But what does this have to do with a Brit investing into a Spanish property in Marbella?

Property Market Analysis Made Easy

Based on real estate odysseys, like the one of Marc, a group of tech-visionaries that shared his struggles created a user-friendly platform, which aggregates all the real estate data and displays it in a minimal and elegant way.

This platform provides property investors, as well as real estate agencies, with over one million correct listings, more than any classified website around. It tracks roughly 300.000 changes per month and updates itself passively, with no extra work needed from the user’s side.

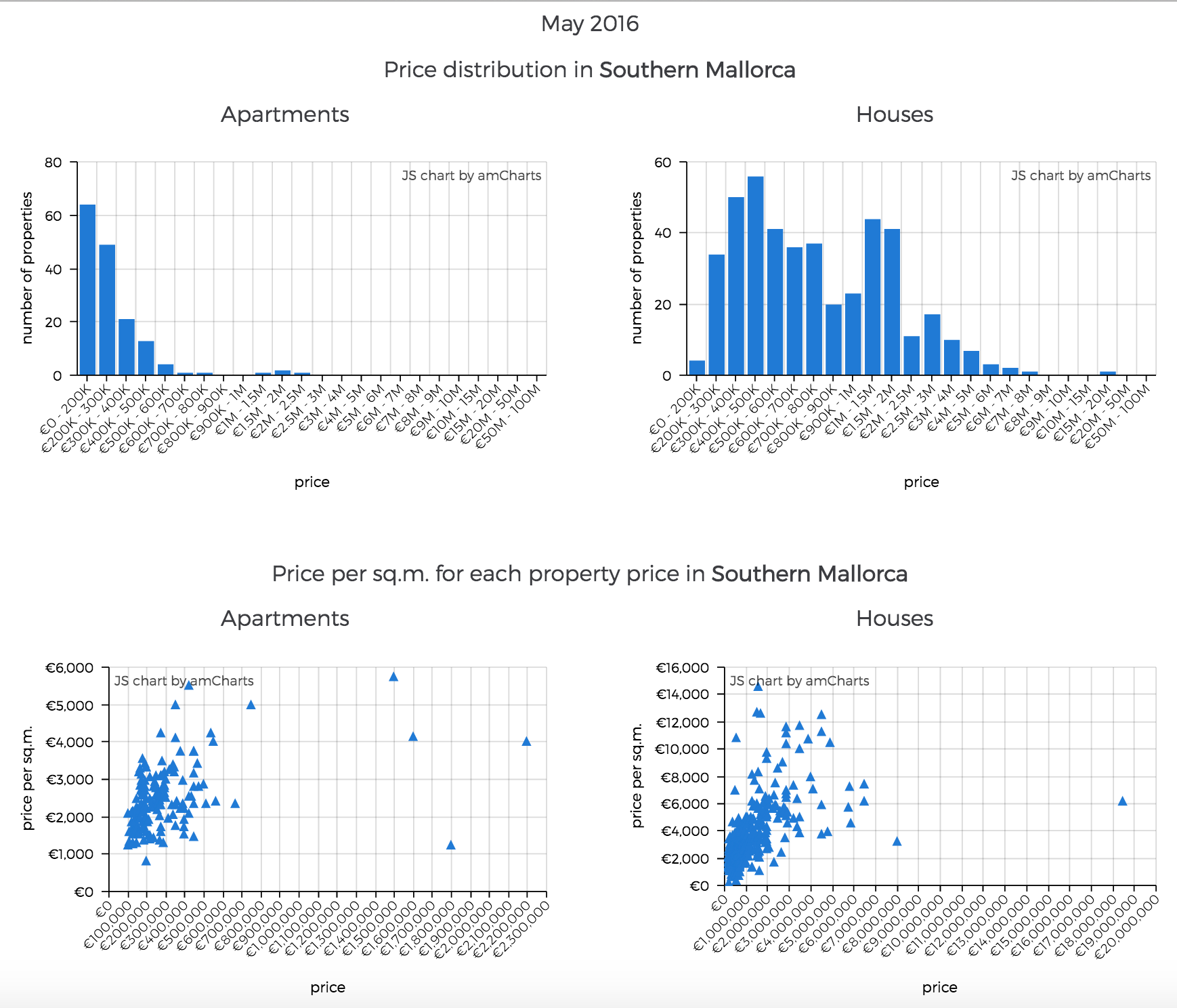

The built-in market watch tool grants insight into the most hyperlocal data. You are able to see price distributions of any property type, as well as the price per square meter for the selected area in real time.

Thanks to AI, you are the first one to identify investment opportunities “to reform” or “to refurbish” coming to the market. You can instantly benchmark them against their peers in the same location. Lucrative areas and hidden gems become visible through a detailed real estate market analysis.

Furthermore, you can look into historical and forecasted data and easily calculate future rental yields and ROI.

Even if you have access to the correct real estate data, it is impossible to make reliable assumptions about the future without the help of machine learning. Contemporary numbers just represent the current situation and not the big picture. Averages don’t reveal time-sensitive dynamics of the market, it’s not clear whether we are at the peak or at the bottom of the curve.

Proptech is a Most Welcome Assistance

Though this is just the beginning of AI and we will certainly hear more from it, Proptech has been already changing the game to the point where all sides can profit from it. Regarding the property market, AI is helping real estate professionals with the dirty work and makes it more efficient.

Property investors are now able to take advantage of the most accurate prediction. Real estate agencies can optimize their property sourcing process, while being able to provide their clients with satisfying information. It is only up to you to make a choice and become a part of the technological change with Proptech.